Business activity in Egypt expanded in November for a fourth month but growth slowed almost to a standstill, a survey showed on Thursday, suggesting the economy is more stable but still fragile.

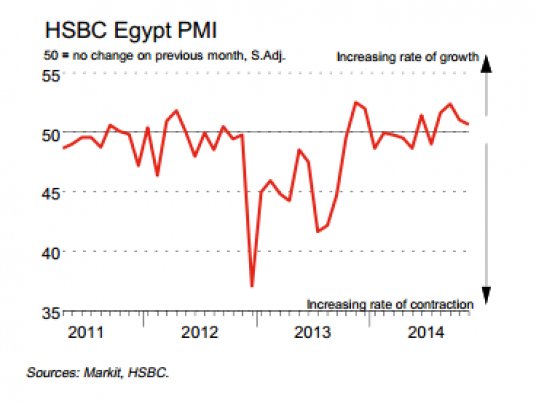

The HSBC Egypt Purchasing Managers Index (PMI) for the non-oil private sector stood at 50.7 points in November, down from 51 points in October and a near-record 52.4 points in September.

Readings above 50 indicate expansion while those below 50 point to contraction.

"Another month with the PMI running above 50 provides further evidence that the Egyptian economy is stabilising," said Simon Williams, Chief Economist for the Middle East at HSBC.

"There are a raft of difficult policy issues still to address, but we continue to look for a pick-up in growth in the year ahead."

Egypt has undergone nearly four years of political and economic turmoil following the 2011 uprising that toppled Hosni Mubarak after 30 years in power.

The government is trying to strike a balance between cutting its deficit and reviving economic growth, which at 2.2 percent in the 2013/14 fiscal year remains too slow to create enough jobs for a youthful population of 87 million.

Though output and new orders continued to expand last month, they did so at a fractional pace, the PMI showed. Employment, which grew in September for the first time in 2-1/2 years, continued to rise but also at a slower rate.

Egypt raised fuel prices by up to 78 percent in July in a long-awaited step to cut subsidies and the budget deficit.

The government is targeting economic growth of up to 5.8 percent in the next three years, with the deficit staying at around 10.5 percent of gross domestic product.

Egypt has been steadily resolving legal disputes with foreign investors and promising reforms of its stifling bureaucracy before a mid-March conference it hopes will help attract billions of dollars in investment.

Weaker foreign demand was at least partly to blame for the slower rate of expansion in November, with new orders falling for the first time since July.

Companies reduced their selling prices last month even as input prices continued to rise, squeezing margins.