Shanghai investors see savings evaporate 02:42

Our mission: Reporting the wild swings of China's stock markets from "ground zero."

And it didn't take long for me to sense the mixed feelings of desperation and resignation upon arrival in Shanghai, China's largest metropolis and business capital.

It also happens to be the site of the country's main stock exchange — and my hometown.

More than anywhere else in China, I know this city is where money reigns supreme.

While Beijing taxi drivers are often well-versed in the latest political gossip, cabbies in Shanghai listen to financial updates on their radios.

Everywhere I turn, I hear people talking about the Chinese stock market losses — more than $3 trillion in the past three weeks:

My long-retired 92-year-old grandfather, the three middle-aged women seated at the table next to ours in a Cantonese restaurant, and the public relations manager at a business school where we filmed — and she's from Jamaica.

Has China's economic bubble burst? 01:57

I also notice an explosion of stock-related posts and comments in my Chinese social media feeds.

Former high school classmates who usually show off their baking accomplishments have switched their focus to the bitter taste that free falling stock prices have left in their mouth — adding a dash of black humor.

"More than 1,000 companies have suspended trading and the state won't have to save the market in a few days — no buying, no hurting," quipped one of them online.

No mood for jokes

The elderly crowd that gathered outside the Shenwan Hongyuan Securities brokerage firm near People's Square was in no mood for any jokes.

Postmortem: Elderly investors trade opinions on the stock markets at a brokerage house in downtown Shanghai after another major sell-off on Wednesday.

Like many other small-time investors, they often spend their entire day trading stocks — as well as financial rumors and political commentaries — in this dimly lit place.

After the closing bell Wednesday, another major sell-off day, the big board was bleeding green — not a good thing in China, where red is an auspicious color.

Here, the usual color-coding in stock prices is reversed: red means up and green indicates down.

Teenager making money in volatile Chinese market 02:45

Several men gave thumbs down to show their displeasure with the latest numbers. Others loudly complained about the depressing developments — comparing their daily investment routine to "psychological warfare" — until they saw our camera.

"We can't talk to foreign reporters about this topic — it's way too sensitive," one man wearing a baseball cap whispered in my ear. "They're going to arrest me for doing that."

Just moments earlier, he was describing the wiping out of his savings and fights with his wife over his investments.

"It's impossible for the market to bounce back any time soon," he said. "This is like the eight-year war against the Japanese. It may take eight years for the market to turn around."

"This is not like stock markets in other countries — this isn't a real market," said an old man in a white shirt.

"Our stock market is purely based on government adjustments. When they want it to go up, it goes up. When they want it to go down, it goes down."

For the first time, though, that very visible hand of the government seems to be slow to work its usual magic — despite a series of quickly announced measures aimed at propping up the plummeting stock markets.

Remarkable turn

It's been a remarkable turn of events.

For months, state media controlled by the ruling Communist Party had been cheering a months-long bull run — making Shanghai the world's best performing market — and encouraging people to invest in stocks amid skyrocketing share prices.

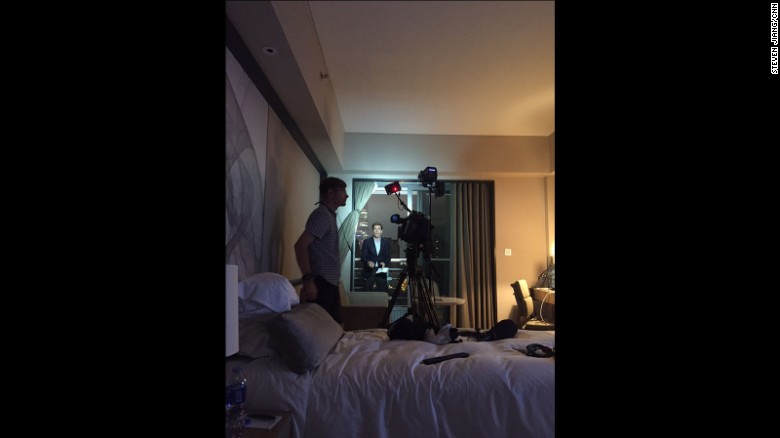

Small window to a big story: Our live shot location on the balcony of our hotel room belies the global impact of the Chinese market news we report form here. The skyline backdrop includes the partially visible 632-meter Shanghai Tower.

As I listened to more venting outside the brokerage house in downtown Shanghai, it dawned on me that the city's name is also a verb — to shanghai someone is to make him do something by using tricks — and that was certainly the sentiment among many here.

As night fell, we stopped by at the city's iconic riverfront, the Bund, to film its famed skylines.

On one side, art deco buildings constructed almost a century ago remind visitors of Shanghai's status as global financial center in the 1920s and 1930s.

Across the Huangpu River, futuristic skyscrapers — long a symbol of the city's soaring ambition to regain its former glory — disappeared into the cloudy sky.

As their reflections glistened in the dark water, journalists and investors alike wondered about the ripple effects — financial and even political — of the volatile stock markets in the world's second-largest economy.