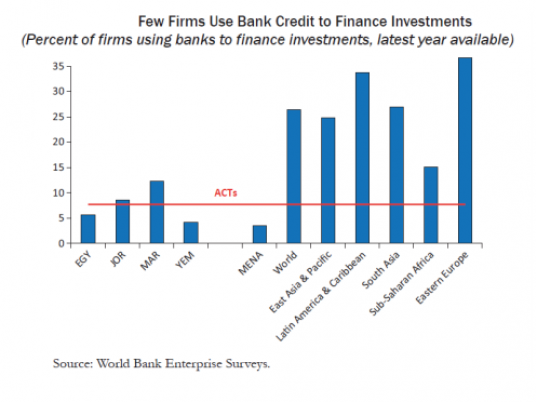

The International Monetary Fund (IMF) said that only 5 percent of Egypt's firms use banks to finance investment, by far the lowest share among the world.

The IMF’s paper titled “Toward New Horizons— Arab Economic Transformation amid Political Transitions,” published earlier this week, explained that lack of access to finance is a major constraint for firms and households in Egypt.

"More than 30 percent of firms identify access to finance as a major constraint, a higher percentage than in all other regions except sub-Saharan Africa", the paper added.

In some in the Arab Countries in Transition (ACTs), which include Egypt, Jordan, Libya, Morocco, Tunisia, and Yemen, only a small share of adults has bank accounts, the report showed.

This low access to finance has been the result of a variety of factors, including poor financial infrastructure, weak banking competition, connected lending and underdevelopment of the non-bank financial sector.

In addition, the IMF’s report pointed out that many banking systems in the ACTs suffer from elevated non-performing loans (NPLs).

High NPLs can hamper the ability of banks to extend new loans and can thus be a drag on economic growth.

Poor risk management in banks, combined with weak financial infrastructures, have resulted in a higher ratio of NPLs compared to other regions.

In some countries, it is also the result of a history of connected lending between state-owned banks and state-owned enterprises.

The economic downturn in the context of political transitions also played a role.

Additionally, the ACTs have severe weaknesses in protecting creditors’ rights: The region ranks last in the area of credit rights as measured by the legal rights index of the World Bank’s Doing Business indicators, the report added.

Insolvency regimes suffer from the lack of efficient exit mechanisms and protection for secured creditors. Improvements in this area can reduce creditor risks and unblocks lending to SMEs and consumers.

Also, bank competition is lower than in most emerging market regions. The ACTs have the largest bank concentration in the world (as measured by the share in total assets of the three largest banks in each country), stifling competition.

Three non-bank financial sectors remain underdeveloped in most ACTs. The non-bank financial sector consists mainly of government bond markets and equities, with little presence of corporate bond issuance, the report explained.

Stock markets in some ACTs are large but have limited trading volume. Encouraging firms to use capital markets for their financing needs would free up lending capacity in banks and could lead them to focus more on lending to SMEs, concluded the report.