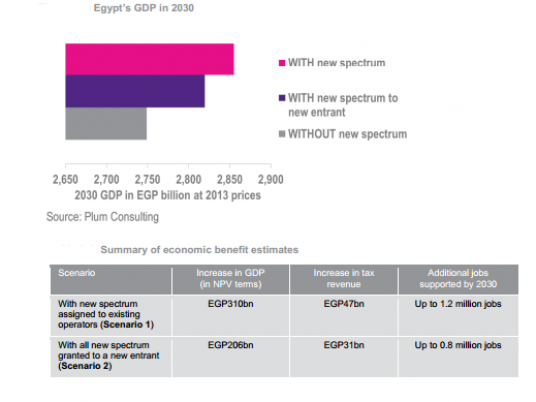

The Egyptian government estimates that the productivity gain to 2030 driven by an unconstrained mobile broadband market is worth around LE310 billion in net present value, according to a report issued by GSM Association (GSMA) on Saturday.

The GSMA report, dubbed "The Economic and Social Impact of Mobile Broadband in Egypt", said that "this growth in GDP would be able to support the creation of up to 1.2 million jobs across the economy by 2030."

"The potential benefits form mobile broadband market are very large," the report added

But, the report explained that "to fully realize the Egyptian government's potential benefits of broadband, one must focus its policies on ensuring that mobile broadband supply is not constrained."

However, these benefits will not be realized unless the government acts now to enable the mobile broadband industry to grow with demand, the report added.

Meanwhile, the Egyptian telecommunications industry has seen rapid growth over the past 10 years, driven by the uptake of mobiles.

Cell phone penetration now exceeds 100 percent and over half of those with mobiles use them to access the Internet in some way.

In 2011, the National Broadband Plan set a target for 2015 of 22 percent of households to be connected to fixed broadband, while 10 percent of citizens (approximately eight million) should be subscribed to mobile broadband.

However, since the publication of the plan, it is clear that these targets are no longer relevant.

Fixed line penetration (for all lines, not just broadband) has fallen to 8 percent of homes, while as of December 2013, it was estimated that 14.5 million Egyptians accessed mobile broadband, well ahead of the target; in fact, this surpasses even the target set for 2021, the report pointed out.

Challenges for operators

As the number of mobile subscribers has grown, from around seven million in 2004 to 100 million in 2014, operators have found that they are increasingly constrained by both the capacity of their networks and the profitability of the service, the report said.

This, combined with an element of regulatory uncertainty over the use of other spectrum bands, makes it difficult for operators to invest in providing their subscribers with better quality of service through sufficient bandwidth, the report pointed out .

Further, operators are unable to significantly increase profitability through changes to the cost base, as many wholesale prices are kept at a high level by the monopoly provision of core networks and international links, even if such monopolies are shifted or rebranded, the report added .

"The government must act to ensure that the overall telecommunications market is structured to support the provision of new and innovative services to end consumers," the report also said.