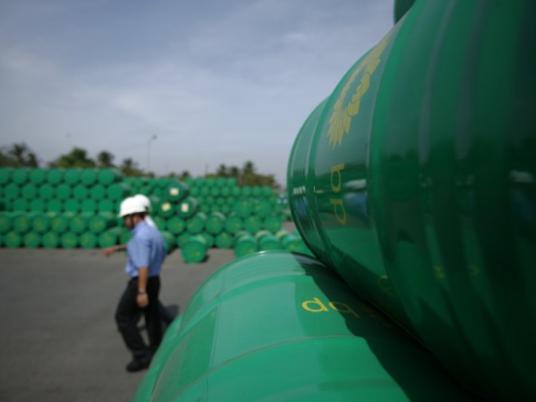

A project that could add 22 percent to Egypt’s natural gas supply is one year behind schedule because local residents in the town of Idku, east of Alexandria, continue to oppose British Petroleum’s (BP) plans to build a processing plant on the town’s seashore.

Natural gas, which was due on-stream in 2014, will now be delivered by 2015 at the earliest. Raafat al-Beltagy, the vice chairman for field development at the state-owned Egyptian Natural Gas Holding Company (EGAS), a supporter of the project, has warned of the delay's potential ramifications for Egypt's electricity sector, the main domestic consumer of natural gas.

“Electricity consumption is growing by 7 percent every year,” said Beltagy in an interview. “We will enter into a crisis if the project does not go ahead.”

The government is spending US$11 million each day to replace the necessary gas with fuel imports, he said, noting that fuel is less environmentally friendly than natural gas for power generation.

Beltagy said that an environmental impact assessment report has been completed that clears the way for the Idku project to go ahead. He added that the report was presented to the public at a conference at Alexandria University, which was attended by the environment minister, the head of the navy and the Beheira governor last month.

However, neither an Egypt Independent correspondent based in Idku nor local residents, who have called for the Egyptian Environmental Affairs Agency (EEAA) to act as an arbiter in the dispute, were aware of the assessment report.

Since September, Idku residents have raised a concerted campaign to derail the project through social media and speaking to the press.

Residents say that the chosen site for the onshore processing plant is too close to local residences. They also are wary of oil and gas companies' operations due to their previous histories of illegally dumping waste into the sea.

“Residents are still opposed to the project because of their experience with the Rashid and Burullus petroleum companies,” Beltagy added. “I have approval from the military and the Ministry of Environment to prepare the site’s ground but I still do not have public consultation. Team experts at BP, British Gas (BG) and EGAS are now conducting a feasibility study to move the processing plant’s location from Idku’s site G to site D in Kafr al-Sheikh Governorate, further to the east.”

Idku is located in the Beheira Governorate, whose governor has taken the side of the protesters.

The new location would make the pipeline connecting the offshore gas field to the onshore processing plant much longer and more complex, as it would cause BP’s pipelines to cross BG’s under the sea. The study will assess the legal and technical complexities of this set-up.

Beltagy could not give a figure yet about how much this move would add to the project’s cost.

If the study finds it is not feasible to move the project to the different location, it will be the prime minister’s decision as to whether or not to go ahead in Idku in spite of local opposition.

Environmental concerns

Industrial waste dumping in the Mediterranean Sea by the Rashid (Rashpetco) and Burullus gas companies was found to be illegal in a 2006 EEAA study. The level of certain chemicals in the waste was found to be above Egypt’s permitted levels.

Residents say this killed off sea life and agricultural lands, consequently hurting fishermen and farmers' trade. They also complain about not seeing enough evidence of benefits for the local community, such as job creation, from the petroleum companies' operations.

Rashpetco, a joint venture between the UK’s BG, Italian power company Edison and the state-owned Egyptian General Petroleum Company (EGPC), produces 420 million cubic feet of gas a day. Burullus, a joint venture between BG, the EGPC and Malaysia’s Petroleum Nasional Berhad (Petronas), produces 1600 million cubic feet of gas a day.

Together, these two companies provide 30 percent of Egypt’s total gas supply, Beltagy said. Italian oil and gas giant ENI provides another 30 percent of domestic demand, and BP says it produces the remaining 40 percent.

A controversial deal

Gas for the Idku project is part of BP and the German firm RWE Dea's northern Alexandria and western Mediterranean offshore deep-water oil concessions, also known as the West Nile Delta oil exploration zones.

Agreements to use these concessions were signed last July under former Petroleum Minister Sameh Fahmy, who is now facing corruption charges. It was the largest deal BP had signed since its oil rig disaster in the Gulf of Mexico and required a $9 billion investment from both partners.

But the beleaguered project is facing further difficulties, as RWE Dea wants to divest from Egypt and is looking to sell part of its stake in the concessions. It is part of a wider RWE Dea 9 billion euro divestment program to boost its balance sheet, following Germany's announcement that it would shut down its nuclear power stations by 2022.

BP, the operator in the concessions, owns 62 percent of the project. RWE Dea owns the remaining 38 percent.

There are around 5 trillion cubic meters of gas in the two offshore deep-water regions. The fields were meant to start producing 900 million cubic meters of gas a day starting in 2014.

The deal was signed after the Egyptian government agreed to pay the partners a higher price for the gas at $3 per cubic meter, up from $2.65. This made the project commercially viable given the technology needed for the deep-water oil exploration, BP said at the time.

But it was also signed at the same time that US President Barack Obama placed a six-month moratorium on deep-water offshore drilling in the Gulf of Mexico, after a massive oil spill there hurt the US's multibillion-dollar tourism and fishing industries in the five states along the Gulf of Mexico.